- Understanding the Paycheck to Paycheck Cycle

- Setting Financial Goals

- Creating and Sticking to a Budget

- Building an Emergency Fund

- Increasing Your Income

- Reducing Debt

- Adopting a Minimalist Lifestyle

- Educating Yourself Financially

- Investing for the Future

- Challenges Along the Path

- Maintaining Financial Health

- FAQ – Common Questions

- Conclusion

Are you tired of living paycheck to paycheck? In this article, you’ll discover 10 proven strategies to stop living paycheck to paycheck, break the cycle, and finally achieve financial freedom.

How many times have you found yourself reaching the end of the month, anxiously awaiting your next paycheck, with little to no savings to show for your hard work? You are not alone. Millions live paycheck to paycheck, struggling to escape the cycle of financial stress. I was once in the same boat, constantly worried about unexpected expenses and how they’d derail my already tight budget. Over time, I’ve found ways to break free from this financial rut, and I’m here to share my journey and the strategies that worked for me.

Understanding the Paycheck to Paycheck Cycle

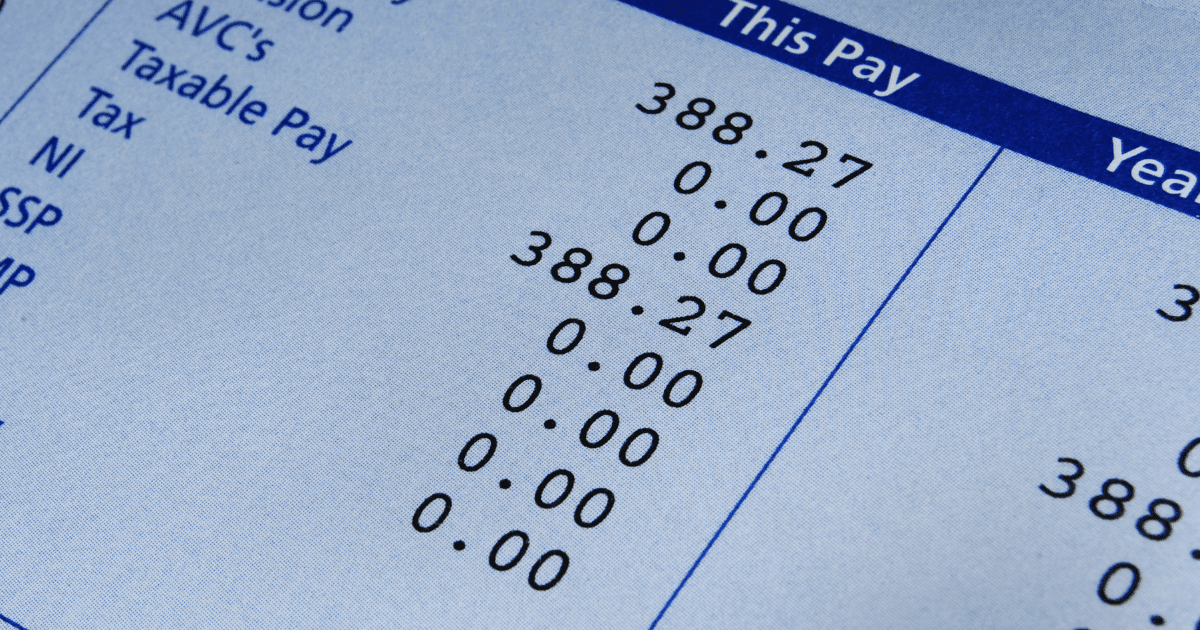

Before finding a solution, it’s essential to understand why many find themselves in this cycle. Most often, it’s a combination of high living costs, stagnant wages, and unexpected expenses. To see how these factors interplay, consider the following table:

| Factor | Impact | Example |

|---|---|---|

| High Living Costs | Consumes excess income | Rent, groceries, utilities |

| Stagnant Wages | Limits financial growth | Annual salary increment under cost-of-living increase |

| Unexpected Expenses | Disrupts savings plan | Medical emergencies, car repairs |

| Lifestyle Inflation | Increased spending | Upgrading gadgets, dining out |

| Lack of Financial Literacy | Poor budgeting skills | No savings or emergency fund |

By understanding these challenges, you begin to see why staying trapped in this cycle is easy, yet finding ways to break free is crucial.

Setting Financial Goals

The first step to financial freedom is setting clear and realistic goals. My journey began with short-term goals like setting aside small amounts each week and gradually moved to more significant commitments, like maintaining a savings account with three months of living expenses. When I started this process, I kept my goals specific, measurable, achievable, relevant, and time-bound.

Here’s what worked for me:

1- Defined short-term and long-term goals.

2- Set a timeline for each goal.

3- Allocated a small portion of my income towards achieving these goals.

4- Regularly reviewed and adjusted goals as needed.

By taking these steps, you too can gain control of your finances.

Creating and Sticking to a Budget

“A budget is telling your money where to go, instead of wondering where it went.” Reflecting on this quote made me realize the power of effective budgeting. It became clear that having a budget isn’t about restricting oneself but about freedom—freedom to make informed financial decisions. I started recording every expense, no matter how small, and identifying areas where I could cut back.

A detailed review of past expenses helped me develop a realistic budget, prioritize essential spending, avoid unnecessary purchases, and ultimately, stick to it without feeling deprived. Regularly reviewing my budget became part of my routine, allowing me to accommodate changes like salary increases or additional expenses.

Building an Emergency Fund

An emergency fund is your financial safety net; it’s not about if you’ll need it, but when. I initially set aside a small percentage of my paycheck into a separate account to ensure I wouldn’t tap into these savings impulsively. Gradually, I built up enough to cover three months’ worth of living expenses.

The more I contributed to this fund, the less anxiety I felt about unexpected expenses. Cashing in on this fund during a car breakdown showcased its necessity and reinforced my commitment to maintaining it.

Increasing Your Income

For many, cutting costs isn’t enough; income needs a boost. I explored multiple avenues to increase my earnings, from freelance gigs to investing in skills that qualified me for better-paying jobs. By diversifying income streams, I found more financial stability and a faster path to breaking the paycheck-to-paycheck cycle.

Reducing Debt

Debt is a severe hindrance to financial freedom. I tackled my debts systematically by focusing on high-interest debts first, using strategies like debt snowball and debt avalanche. Reducing and managing debt opened avenues for better financial health, allowing me to allocate more towards savings and investments.

Adopting a Minimalist Lifestyle

Embracing minimalism was a game-changer. By focusing on what truly adds value to my life, I curbed unnecessary spending. Decluttering physical space and financial habits encouraged me to live below my means, creating a sense of liberation from consumerism traps.

Educating Yourself Financially

Knowledge is power. Financial literacy became a priority—reading books, attending workshops, and utilizing online resources. This newfound understanding empowered me to make informed decisions, spot better investment opportunities, and manage money wisely.

Investing for the Future

Once my financial foundation was strong, I turned to investment opportunities to build wealth. I explored options like stocks, retirement accounts, and real estate. With informed decisions and a clear risk assessment, I secured additional income streams and long-term financial security.

Challenges Along the Path

Every journey faces hurdles, and mine was no different. The key was resilience and adaptability. Facing setbacks like unexpected medical bills or fluctuating income taught me to refine my strategies, focusing on flexibility and long-term vision. Patience and perseverance are crucial traits in overcoming these inevitable challenges.

Maintaining Financial Health

Achieving financial wellness isn’t a destination but an ongoing journey. Regularly reviewing financial plans and making necessary adjustments ensure sustained progress. Celebrating small victories along the way keeps the motivation alive and strengthens financial discipline.

FAQ – Common Questions

How do I start budgeting effectively?

Begin by tracking your expenses, categorizing them, setting spending limits, and regularly reviewing your budget to stay on track.

What’s a realistic initial goal for an emergency fund?

A good start is setting aside at least $500, gradually working toward covering three to six months of living expenses.

Can a side hustle improve my financial situation?

Yes, a side hustle can supplement your income, helping to pay off debts faster or build savings.

How can I stay motivated on this financial journey?

Set measurable goals, track progress, and celebrate small milestones to maintain motivation and financial focus.

Is it possible to invest with little money?

Absolutely, options like micro-investing apps let you start investing with minimal capital.

Conclusion

Breaking free from the paycheck-to-paycheck cycle isn’t an overnight process but a commitment to changing financial habits and mindsets. By setting clear goals, maintaining a budget, and seeking continuous education, anyone can regain control over their finances and build a secure future. I have navigated this journey with its ups and downs, each step bringing me closer to financial freedom. Remember, small, consistent actions lead to significant changes, a mantra that I’ve found profoundly transformative.