Ever found yourself eyeing that shiny new gadget, tempted by the Buy Now, Pay Later offer that feels like a steal? You’re not alone—those easy payment plans are everywhere, promising instant gratification without the upfront cost. But here’s the catch: they might be hiding some nasty surprises.

If you’re just starting to navigate personal finances, the allure of splitting payments can feel like a lifeline. In this article, you’ll uncover the real cost of these services and learn how to protect your wallet. Let’s dive in!

What Are Buy Now, Pay Later Services Really About?

Hey, let’s dive into the world of Buy Now, Pay Later (BNPL) services. You’ve probably seen these options pop up at checkout, promising an easy way to snag that item you want without paying upfront. But what’s the deal behind them?

These services aren’t just a trendy payment hack; there’s more to unpack. From how they operate to why they’re so tempting, let’s break it down.

Stick with me as we explore the basics. We’ll cover the mechanics, the big players in the game, and why you might feel drawn to click that BNPL button.

How These Services Work in Simple Terms

So, how does BNPL actually work? It’s pretty straightforward: you buy something online or in-store, but instead of paying the full price now, you split it into smaller chunks over time.

Most services offer interest-free payments if you stick to the schedule. Miss a payment, though, and fees can pile up fast. It’s like a mini-loan without the bank hassle.

Popular Platforms Offering This Payment Option

You’ve likely come across some big BNPL names. Platforms like Affirm, Klarna, and Afterpay are everywhere, integrated into tons of online stores.

Others, like Sezzle and PayPal Pay in 4, are also gaining traction. They’re super easy to spot at checkout with their flashy “Pay Later” buttons.

Want a quick rundown? Here are some popular ones:

- Affirm: Often used for bigger purchases.

- Klarna: Huge in fashion and lifestyle shops.

- Afterpay: Popular for smaller, frequent buys.

Why They Seem So Appealing to Beginners

Let’s be real—BNPL feels like a lifesaver when you’re eyeing something pricey. You get instant gratification without draining your bank account upfront.

It’s marketed as “no interest” or “no fees” (if paid on time), which sounds like a dream. Plus, the approval process is usually a breeze compared to credit cards.

But here’s the catch: it’s easy to overspend. That “pay later” vibe can trick you into buying more than you can handle. Tempting, right?

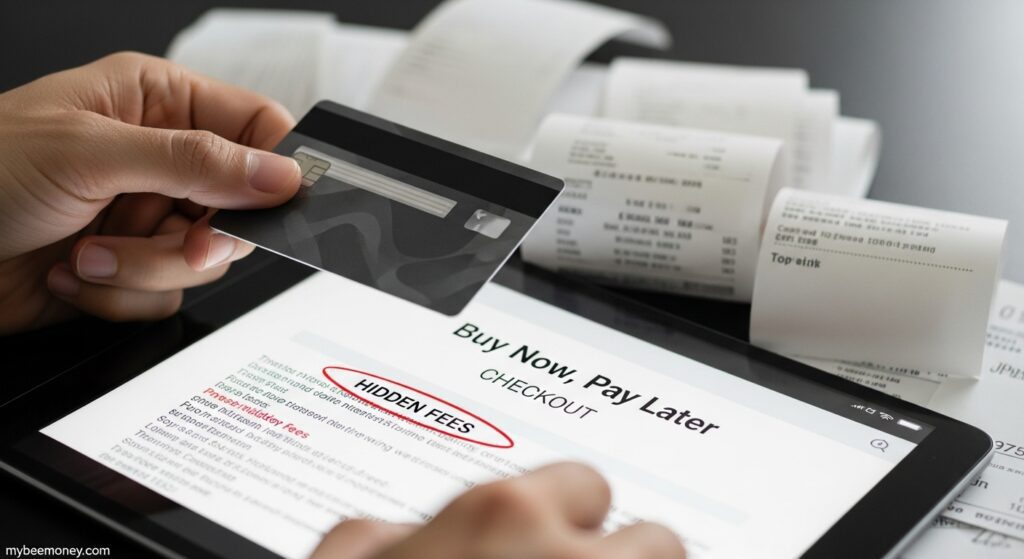

The Hidden Fees Lurking Behind Easy Payments

Hey, you might think buy now, pay later services are a lifesaver when you’re short on cash. But hold up—those easy payments often come with some nasty surprises. Let’s peel back the curtain and look at the hidden fees that could sneak up on you.

These services don’t always advertise the extra costs upfront. Before you know it, you’re stuck with charges you didn’t expect. Let’s break down the big ones you need to watch out for.

Late Payment Penalties You Might Overlook

Miss a payment? You’re in for a rude awakening. Many buy now, pay later platforms slap on late fees that can sting—sometimes as much as $10 or more per missed installment.

It might not sound like much, but if you’re juggling multiple plans, those fees add up fast. According to a report by the Consumer Financial Protection Bureau, some users rack up hundreds in penalties without realizing it.

Interest Rates That Can Pile Up Fast

Some services claim to be interest-free, but that’s not always the full story. If you miss a payment or opt for longer plans, interest rates can kick in—and they’re often sky-high.

We’re talking rates as high as 30% in some cases. That cute outfit you split into payments? It could cost double if you’re not careful with the fine print.

Other Sneaky Costs to Watch Out For

Beyond late fees and interest, there are other hidden costs lurking. Watch out for things like:

- Processing fees: Some platforms charge just for setting up your plan.

- Return fees: Returning an item? You might still owe a fee.

- Overdraft fees: If a payment pulls from your bank and you’re short, your bank might hit you with a charge.

These little extras can turn a small purchase into a big headache. Keep your eyes peeled for the fine print before you click “buy.”

How They Impact Your Credit Score and Finances

Hey, let’s talk about something super important—how Buy Now, Pay Later (BNPL) services can mess with your money and credit score. It’s not just about those easy payments; there’s a bigger picture to consider.

These services might seem like a lifesaver, but they can sneakily affect your financial health. From hidden risks to long-term consequences, let’s break it down.

I’ve split this into a few key areas so you can see the full impact. Stick with me as we dive into the details below.

Potential Damage to Your Credit Report

You might think BNPL doesn’t touch your credit score, but that’s not always true. Some providers report missed payments to credit bureaus, which can tank your score fast.

If you’re late on a payment, it could show up as a negative mark. According to a report by Experian, even one missed payment can hurt your rating for years.

Risk of Overspending and Debt Traps

BNPL can trick you into spending more than you’ve got. With deferred payments, it’s easy to lose track of what you owe.

Before you know it, you’re juggling multiple plans and drowning in debt. Here’s how to avoid the trap:

- Set a strict budget before shopping.

- Track every BNPL purchase in a spreadsheet.

- Avoid stacking multiple payment plans at once.

Long-Term Effects on Financial Health

Using BNPL too often can mess with your financial stability over time. Those small purchases add up, eating into your savings or emergency fund.

Plus, if you’re always paying off stuff, you’ve got less room for big goals like buying a car or house. It’s a slow drain on your future.

Think twice before clicking that tempting BNPL button. Your wallet will thank you later.

Psychological Tricks That Keep You Spending

Hey, have you ever wondered why Buy Now, Pay Later services feel so tempting? It’s not just about convenience; there’s some serious psychology at play. These platforms are designed to mess with your head, nudging you to spend more than you planned.

They tap into how you think and feel about money. It’s like a mind game, and you’re the player who doesn’t even know the rules. Let’s break down the sneaky tricks they use to keep your wallet open.

We’ll dive into specific tactics that mess with your perception of affordability. Plus, we’ll uncover marketing moves that push you to buy on impulse.

Stick with me as we also explore how to break free from this spending trap. It’s time to outsmart these psychological ploys!

The Illusion of Affordability Explored

Ever notice how splitting a $100 purchase into four payments feels like a steal? That’s the illusion of affordability at work. Buy Now, Pay Later makes big purchases seem small by breaking them into tiny chunks.

Your brain tricks you into thinking you’re saving money. But in reality, you’re still spending the full amount—just over time. This mindset can lead to overspending without you even noticing.

Marketing Tactics That Encourage Impulse Buys

These services are pros at pushing your impulse buttons. Pop-up ads scream “Pay later, enjoy now!” right when you’re about to check out. It’s hard to resist when it feels so urgent.

They also partner with your favorite stores, placing tempting offers where you can’t miss them. According to a report by Consumer Insights Group, over 40% of users admit to buying stuff they didn’t need because of these prompts. That’s no accident!

Breaking Free from the Spending Cycle

Ready to take back control? Start by recognizing these tricks for what they are—mind games. Pause before hitting that checkout button and ask if you really need the item.

Here are a few quick tips to stay grounded:

- Set a strict budget before shopping online.

- Turn off notifications for tempting deals.

- Track every purchase to see the real cost.

It’s all about building habits that protect your wallet. You’ve got this—don’t let sneaky tactics win!

Smarter Alternatives for Managing Your Money

Hey, you don’t have to fall into the trap of buy now, pay later schemes to get what you want. There are smarter ways to handle your cash without risking hidden fees or credit damage.

Let’s be real—managing money isn’t always fun, but it’s doable. You just need practical steps to stay on top of your finances.

That’s why I’ve got some solid alternatives for you. These ideas will help you avoid impulse buys and keep your wallet happy.

Stick with me as we dive into budgeting tricks, saving hacks, and other payment options that actually work for you.

Budgeting Tips to Avoid These Services

First off, creating a budget is your best defense against overspending. Start by tracking every dollar you spend for a month to see where your money goes.

Use a simple app or even a notebook. It’s eye-opening to spot unnecessary expenses you can cut.

Here’s a quick game plan to stay disciplined:

- Set a monthly spending limit for non-essentials.

- Allocate a small “fun fund” for guilt-free splurges.

- Review your budget weekly to stay on track.

This way, you’re in control and less tempted by risky payment traps.

Saving Strategies for Big Purchases

Want that shiny new gadget without the debt? Start saving for big purchases instead of swiping now and stressing later.

Pick a specific goal, like saving $500 for a laptop. Break it into smaller chunks—say, $50 a month—and automate transfers to a savings account.

It’s all about patience. Skip a few coffees or streaming subscriptions temporarily to hit your target faster.

Small wins add up. Before you know it, you’ll have the cash to buy outright, no strings attached.

Other Payment Options Worth Considering

If saving upfront isn’t an option, explore safer payment methods than buy now, pay later. Credit cards with low interest or 0% intro offers can work if you pay on time.

Layaway plans are another old-school but smart choice. You pay in installments before taking the item home—no debt, no fees.

Even personal loans from a trusted bank might beat predatory services. Just read the fine print to avoid surprises.

These options keep your finances in check while dodging the pitfalls we’ve already talked about.

ConclusION

Hey, let’s wrap this up! Buy Now, Pay Later services might seem like a quick fix, but those hidden fees and debt traps can sneak up on you fast. It’s not always the deal it appears.

Think twice before clicking that button. Do you really need it now, or can you save up? Take a sec to weigh the real cost before diving in.

FAQ: The Real Cost of Using Buy Now, Pay Later Services

How do BNPL services affect your credit score?

They might not always report to credit bureaus, but late payments can ding your score if they do. Check the platform’s policy to stay safe.

Can you return items bought with BNPL plans?

Yes, most stores allow returns, but you might still owe the remaining payments. Always read the merchant’s return policy alongside the BNPL terms.

Are there limits to how much you can spend with BNPL?

Yup, most platforms set spending caps based on your creditworthiness or payment history. Limits can range from a few hundred to thousands of dollars.

Do BNPL services encourage impulse buying?

Definitely, their “pay later” setup can push you to buy stuff you don’t need. Set a budget before shopping to avoid this trap.

What happens if you can’t pay a BNPL installment at all?

If you can’t pay, some services offer hardship options like payment pauses, but you’ll need to contact them ASAP. Ignoring it could lead to debt collection.