- An Introduction to Understanding Pay Stubs

- Decoding the Mysteries of Deductions

- The Importance of Tax Withholdings

- Analyzing Employer Contributions and Benefits

- Impact of State-Specific Regulations

- Steps to Take for Adjusting Withholdings

- The Pivotal Role of Pay Stubs in Financial Planning

- FAQ – Common Questions

- Conclusion

Are you confused about your paycheck and want to know how to understand your paycheck and withholdings? This guide will break down each section of your pay stub, explain what withholdings mean, and help you spot any errors so you can take control of your finances.

How often do you glance at your pay stub without really understanding the details? Many people find themselves puzzled by the various numbers and terms used in their pay stubs. Therefore, let’s dive into the nuances of understanding your pay stub and withholdings to ensure you’re fully aware of how your hard-earned money is accounted for.

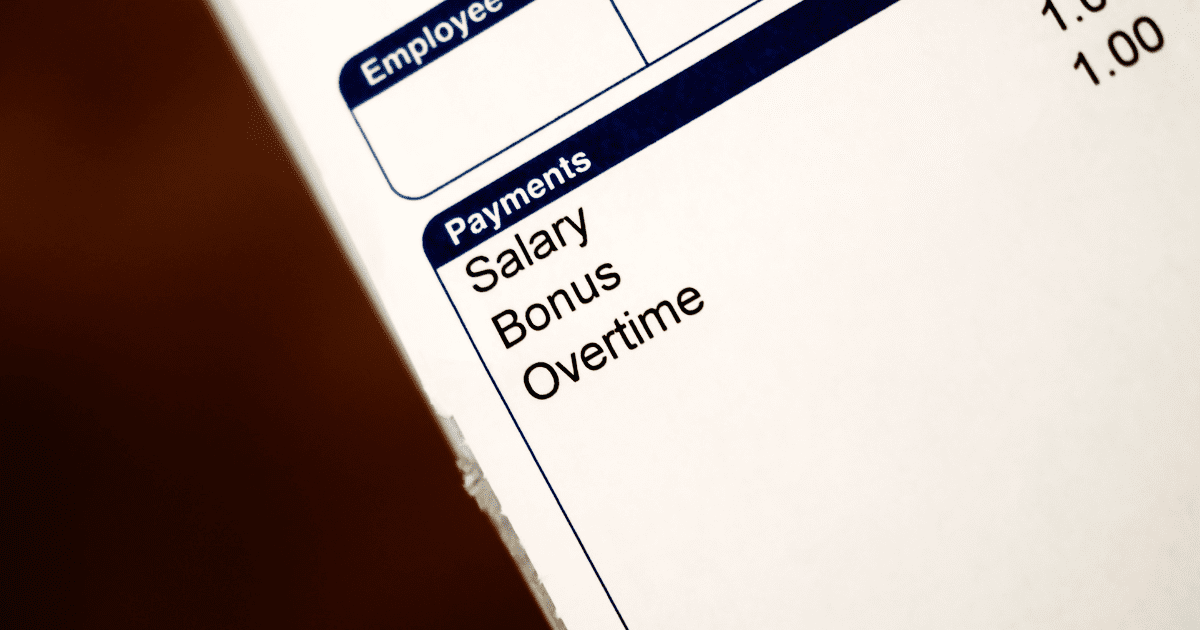

An Introduction to Understanding Pay Stubs

At first glance, a pay stub may seem like a bewildering array of numbers and codes. Each part of the stub holds significant meaning about your earnings and deductions. A typical pay stub will showcase your gross pay, which is your total earnings before any taxes or deductions are taken out. This figure includes everything you have earned for that particular pay period, whether it’s weekly, bi-weekly, or monthly. Trust me; there’s a lot more here than meets the eye.

Decoding the Mysteries of Deductions

Breaking down these deductions can feel like deciphering a foreign language. However, it’s crucial to settle any confusion regarding where a portion of your salary is diverting. Deductions typically fall into mandatory and voluntary categories. Mandatory deductions include federal and state taxes, social security, and Medicare. Voluntary deductions might consist of health insurance premiums or retirement contributions. Let’s take a look at a quick reference table to understand deductions better.

| Deduction Type | Description | Example |

|---|---|---|

| Federal Tax | National tax collected by IRS | Income Tax |

| State Tax | State-specific income tax | Varies by State |

| Social Security | Government retirement fund | 6.2% (as of 2023) |

| Medicare | Health insurance for elderly | 1.45% (as of 2023) |

The Importance of Tax Withholdings

When your employer withholds money from your paycheck to pay your taxes on your behalf, this is known as tax withholdings. It’s important to realize how withholdings impact your take-home pay and potential tax refunds or liabilities. Incorrect withholdings can either cause undue financial strain through too little net pay or surprise you with tax balances owed during filing season.

To be ignorant of what occurs on our pay stub is to place the management of our finances in someone else’s hands entirely.

Analyzing Employer Contributions and Benefits

One aspect often overlooked by employees is the contributions made by employers towards various benefits. These can include health insurance contributions, retirement plan matches, or even stock options. Understanding these benefits ensures that you are aware of the full compensation package your employer provides. These contributions significantly impact your total compensation and should not be underestimated.

Impact of State-Specific Regulations

Each state in the United States has its own specific tax rates and regulations. This variability can affect your net pay significantly. For those residing in states with no income tax, such as Texas or Florida, understanding the trade-offs in state-level taxation policies is essential for comprehensive personal financial planning.

Steps to Take for Adjusting Withholdings

If you identify incorrect withholdings, you might wonder how to make necessary adjustments. Making changes to your withholdings typically involves submitting an updated W-4 form to your employer. Here’s a straightforward approach:

1. Review: Regularly assess your tax situation.

2. Compare: Use online calculators to estimate future dues.

3. Consult: Consider speaking with a tax advisor for personalized advice.

4. Submit: Adjust your W-4 based on advice and personal research.

The Pivotal Role of Pay Stubs in Financial Planning

Understanding your pay stub and the deductions listed therein critically affects your personal finance management. With awareness comes the power to make informed financial decisions, set realistic budgets, and achieve your financial goals progressively.

FAQ – Common Questions

What information is typically shown on a pay stub?

A pay stub usually includes gross pay, total deductions (like taxes and benefits), and net pay or take-home amount.

How are tax withholdings determined?

Withholdings are determined based on your W-4 form, which you complete at the start of employment or whenever you adjust your tax situation.

Can I change my tax withholdings?

Yes, you can submit a new W-4 form to your employer at any time to adjust your withholdings.

Are employer contributions to benefits taxable?

No, typically employer contributions to benefits like retirement funds or health insurance aren’t taxed as part of your income.

What happens if there’s an error on my pay stub?

If you notice an error, contact your employer’s HR department immediately to rectify the situation.

Conclusion

In conclusion, comprehending the details of your pay stub is crucial for managing your financial health effectively. Although the multitude of numbers might seem daunting, taking the time to decode your pay stub’s components empowers you to control your personal finances. Knowledge is indeed power, and with a clear understanding of your pay stub, you are well-equipped to manage your financial future with confidence.