What Is a Credit Score?

Do you know what is a credit score and why it’s so important for your financial life? In this guide, you’ll learn how credit scores work, what factors affect them, and why understanding your credit score is crucial for achieving your financial goals.

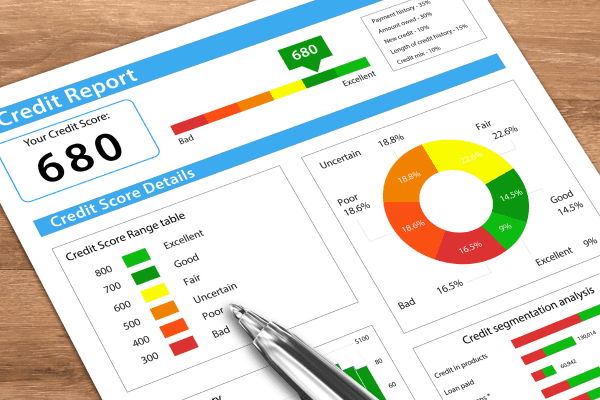

Have you ever wondered why financial institutions seem so interested in a three-digit number on a piece of paper? This mysterious number is your credit score, a vital statistic that hinges on your financial life. A credit score fundamentally is a numerical representation of your creditworthiness. While it may seem like an everyday aspect of adult life, understanding its intricacies can significantly impact your financial prospects.

It is calculated by credit bureaus based on your credit history, which includes your borrowing habits, repayment records, credit mix, and new credit activity. More than just a number, it predicts the likelihood of you repaying a loan and thus is a crucial tool for lenders when deciding whether to extend credit or approve a new loan request.

Understanding Credit Score Indicators

Credit scores are influenced by various factors, each contributing differently to its calculation. Here is a breakdown of the primary components that influence your credit score:

| Factor | Contribution to Credit Score | Details |

|---|---|---|

| Payment History | 35% | Timely payments on credit accounts. |

| Credit Utilization | 30% | Ratio of current credit card balances to credit limits. |

| Credit History Length | 15% | Length of time your credit accounts have been active. |

| Credit Mix | 10% | Variety of credit accounts you have. |

| New Credit | 10% | Recent credit inquiries and newly opened accounts. |

Understanding these components can demystify how your financial actions impact your credit score. Each aspect reflects your financial behavior and predicts how reliably you will pay back borrowed money. The higher your score, the better your perceived creditworthiness.

Why Your Credit Score Matters

A credit score influences numerous facets of your financial life. It serves as a financial passport that lending institutions rely on to evaluate the risk of lending to you. A higher score can unlock better interest rates, loan terms, and even approvals for major financial commitments such as mortgages or car loans.

It can also affect your eligibility for certain credit cards and the interest rates attached to them. However, the implications extend beyond borrowing; landlords, insurance companies, and sometimes even employers may use credit scores to make decisions about rental eligibility, premiums, or job applications. In essence, a good credit score opens doors to better financial opportunities and savings over time.

The Impact of a Poor Credit Score

Your credit score is like a report card for your finances, reflecting the entirety of your financial habits in a single number.

Having a low or poor credit score can pose significant challenges. If your credit score falls in the lower range, it can be much harder to secure loans, and when you do, they often come with higher interest rates. This means that borrowing money becomes more expensive, leading to a cycle of increasing financial strain.

Poor credit can also hinder your ability to rent an apartment or secure a favorable insurance premium. Unfortunately, it might even affect your employability, as more employers are beginning to factor credit scores into their hiring processes, particularly for positions that require financial judgment or handle money.

Improving Your Credit Score

If you are grappling with a mediocre or poor credit score, the path to improvement requires discipline and strategic financial behavior. Here are a few steps you can take to improve your credit score effectively:

1- Consistently pay your bills on time.

2- Reduce your credit card balances and maintain a low credit utilization rate.

3- Avoid opening new credit accounts unless necessary.

Regularly checking your credit report from major credit bureaus to ensure there are no inaccuracies is also crucial. Discrepancies or errors in your report can unfairly drag your score down, so rectifying these promptly can boost your standing.

The Role of Credit Reports

A credit report is a detailed account of your credit activities and current credit status. Think of it as the narrative that supports your credit score. These reports contain information about your credit accounts, payment history, outstanding debts, and any negative marks such as foreclosures, bankruptcies, or late payments.

Familiarizing yourself with your credit report gives you insight into what lenders see and therefore allows you to manage your credit health proactively.

By law, you are entitled to one free credit report per year from the three major credit bureaus: Experian, TransUnion, and Equifax. Reviewing these reports regularly can help identify areas for improvement, avoid identity theft, and ensure your financial narrative is accurate.

Credit Score Myths and Misconceptions

Many people fall prey to myths and misconceptions about credit scores, which can mislead them into making poor financial decisions. For example, some believe that checking your own credit report lowers your score—this isn’t true. Self-inquiries are considered soft pulls and don’t negatively influence your score.

Another common myth is that closing old credit accounts will increase your score. In reality, closing accounts can reduce your credit history length and available credit, potentially lowering your score. It’s important to distinguish fact from fiction to better manage your financial health and avoid erroneous decisions that might harm your credit score.

If you want to improve your overall financial health and learn how to manage your money better, check out our guide on how to shop smart and avoid impulse buying.

FAQ – Common Questions About Credit Scores

How often is my credit score updated?

Your credit score is generally updated whenever any of your creditors report new financial data. This could be monthly or as transactions occur.

How can I check my credit score?

You can check your credit score through various financial services, some banks and the official credit bureaus offer free credit monitoring services.

Does having multiple credit cards hurt my credit score?

Having multiple credit cards doesn’t necessarily hurt your score as long as you manage them responsibly, keeping balances low and paying bills on time.

Are there different types of credit scores?

Yes, there are, including FICO scores and VantageScores, each using different calculation models but generally focusing on similar factors.

Do co-signed loans affect my credit score?

Yes, co-signed loans can affect your credit score. As a co-signer, you’re equally responsible for the debt, and any late payments will impact your score.

Conclusion

Understanding and maintaining a healthy credit score is essential to secure favorable financial opportunities and save money on interest rates and insurance premiums. As a reflection of your financial habits and creditworthiness, your credit score is a critical tool not just for creditors but also for you. Taking proactive steps to manage and improve your credit can lead to long-term financial benefits, ensuring you have access to credit when needed and are trusted to handle financial responsibilities effectively.